2025 Taxable Social Security Calculator. A new tax season has arrived. Social security taxable benefit calculator.

How does a social security calculator work? The standard deduction is bigger for taxpayers who are at.

For 2025, the standard deduction is $14,600 for individuals and $29,200 for married couples filing jointly.

Taxable Social Security Calculator, Social security benefits if you begin. So benefit estimates made by the quick calculator are rough.

Taxable Social Security Benefits Calculator YouTube, If you have a personal my social security account, you can get an. The maximum social security benefit for 2025 is expected to be $3,822 per month at full retirement age.

How to Calculate Taxable Social Security (Form 1040, Line 6b) Marotta, For sure, this is a good amount. The maximum social security benefit for 2025 is expected to be $3,822 per month at full retirement age.

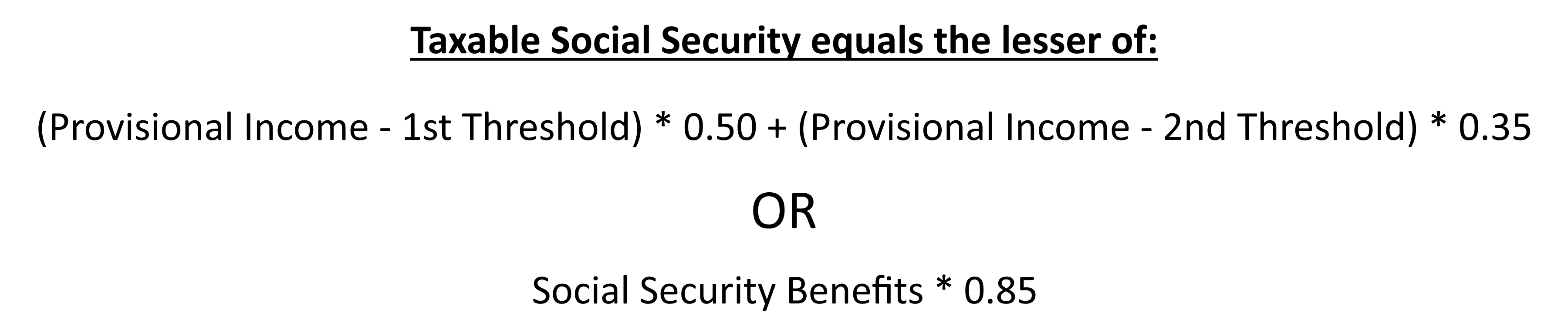

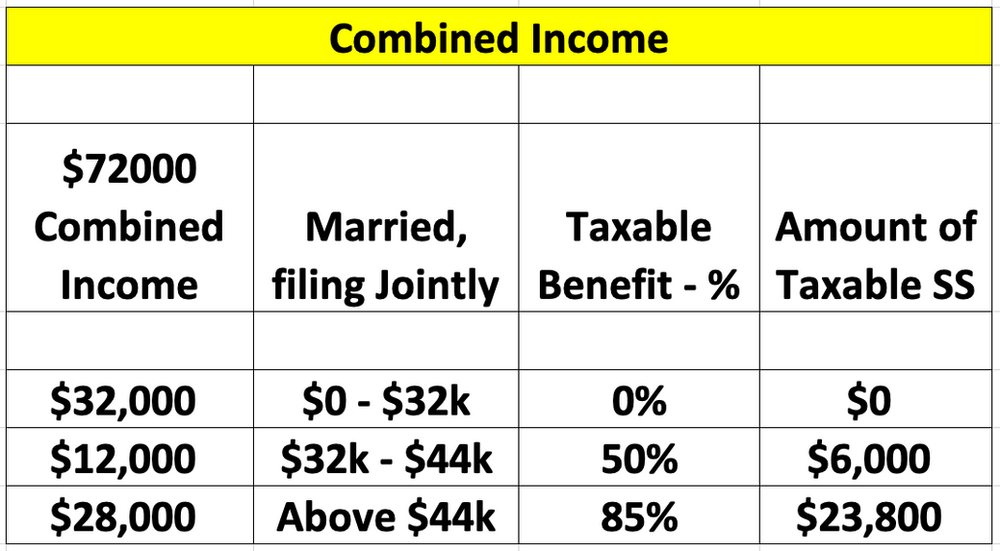

Calculate Taxable Social Security Benefits 2025, Up to 50% of your social security benefits are taxable if: If you make $70,000 a year living in hawaii you will be taxed $12,413.

Resource Taxable Social Security Calculator, Enter total annual social security (ss) benefit amount. So benefit estimates made by the quick calculator are rough.

Taxable Social Security Benefits Calculator (2025), This taxable social security benefits calculator will give you an estimate of how much you’ll have to pay in taxes on your monthly. Your average tax rate is.

Social Security Taxable Calculator Top FAQs of Tax Oct2022, With that in mind, here are three basic rules you should commit to memory before putting in your claim. The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

What Is The Taxable Amount On Your Social Security Benefits?, For example, say you receive $2,800 per month in social security in 2025, meaning you’ll. You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

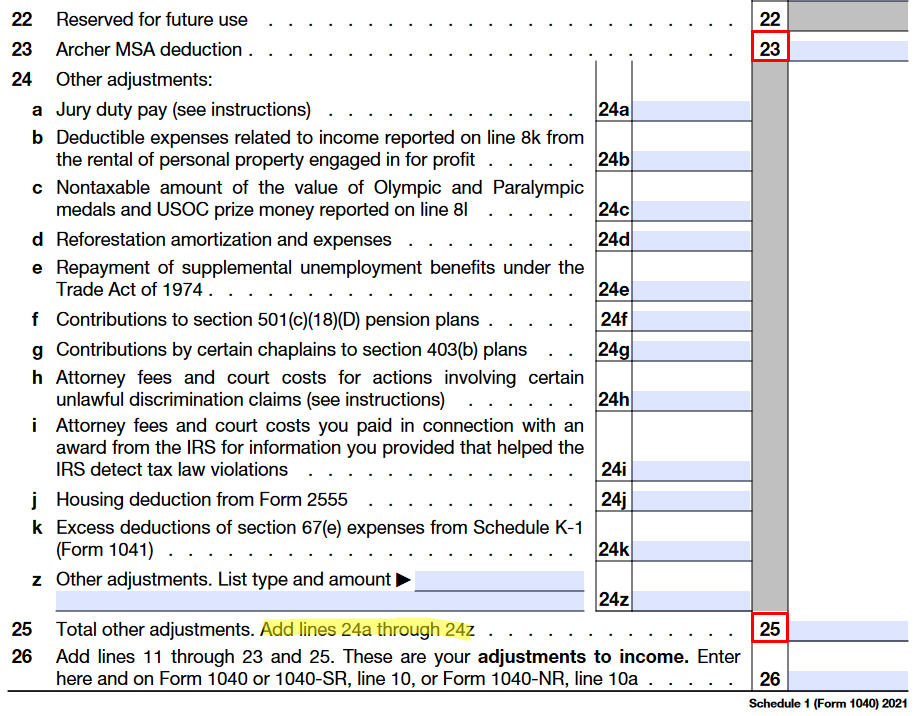

How to Calculate Taxable Social Security (Form 1040, Line 6b) Marotta, Social security benefits if you begin claiming at age: How social security tax is calculated.

Taxable social security worksheet 2025 Fill out & sign online DocHub, Enter total annual social security (ss) benefit amount. The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.